Bitcoin Market Analysis: Leverage, Funding, and Risk Assessment (Short-Term)

Recent data highlights a highly leveraged and fragile Bitcoin market. Let’s break it down:

🚀Join CDDStamp for free and unlock instant access to these powerful insights — no cost, just alpha.

🔵 1. Estimated Leverage Ratio (ELR)

-

The ELR has surged above 80, indicating extreme leverage.

-

This means the market is extremely sensitive to small price changes.

-

High ELR = High liquidation risk 🚨

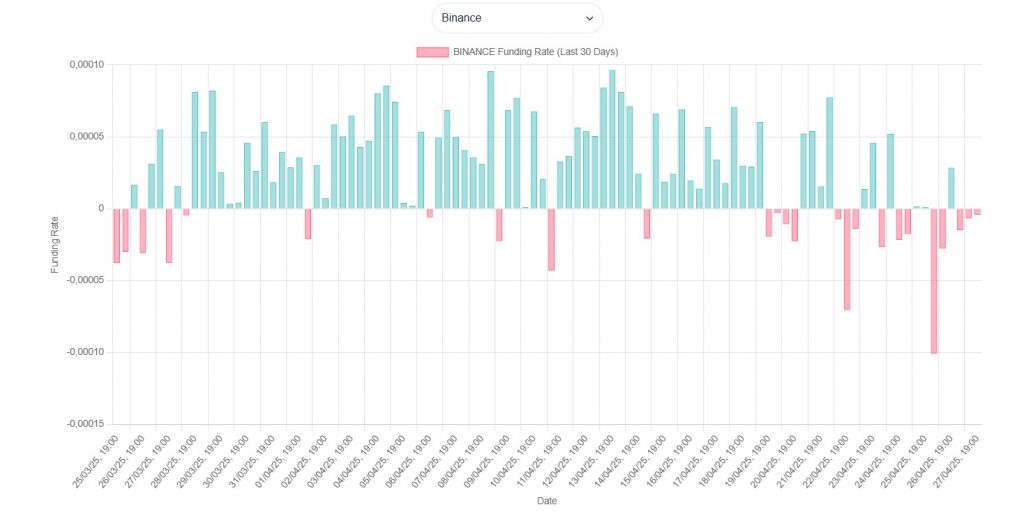

🟣 2. Funding Rate

-

Funding rates have turned negative around April 24-26.

-

This shows that short positions are heavily loaded.

-

A sharp short squeeze (price spike) could occur if funding remains negative for long.

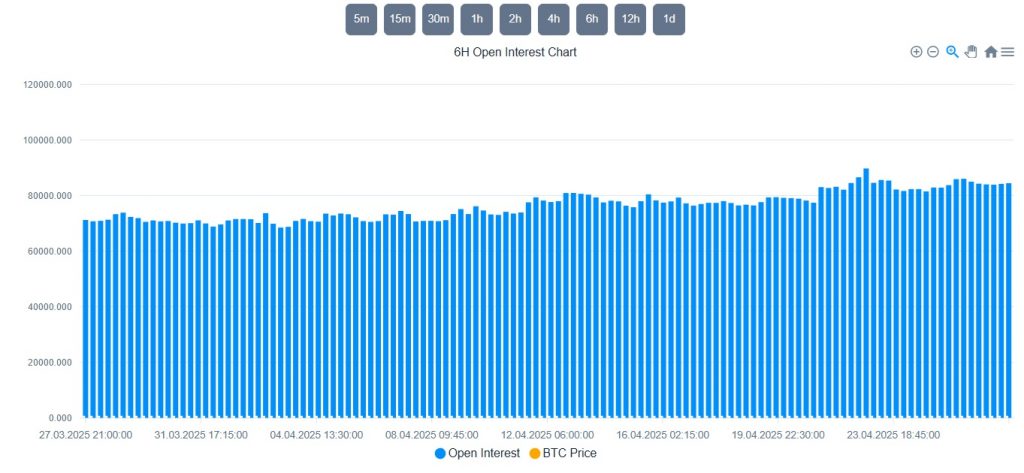

🔵 3. Open Interest (OI)

-

Open Interest is steadily increasing alongside price.

-

This indicates speculative buildup, but no major liquidation events yet.

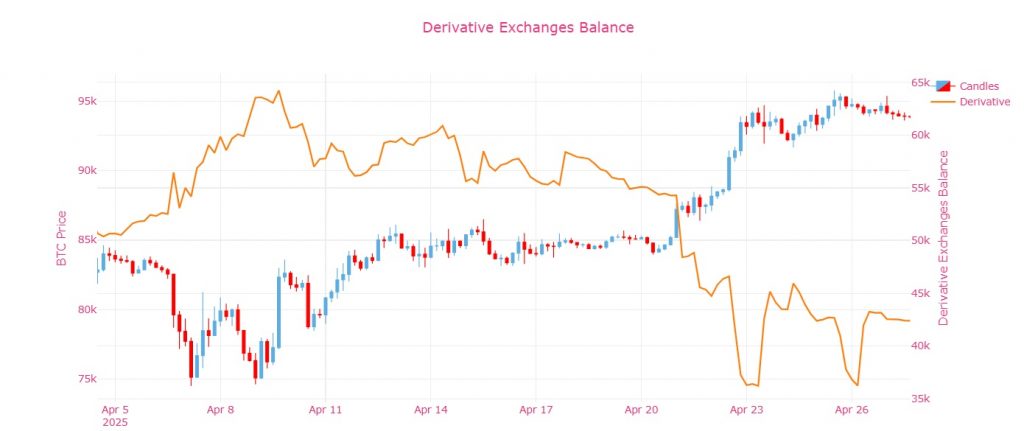

🟠 4. Exchange Bitcoin Balance

-

BTC reserves on exchanges are rapidly dropping.

-

This suggests reduced selling pressure and potential bullishness over time.

📌 Summary:

| Aspect | Insight |

|---|---|

| ELR very high | Overleveraged market, prone to liquidation events |

| Funding negative | Heavy shorts, risk of a short squeeze |

| Open Interest rising | Speculative positions accumulating |

| Exchange balance dropping | Decreased selling pressure |

➡️ Conclusion:

The market is extremely risky right now. Sudden sharp moves—either up or down—are very likely.

🚀 Short-Term Trading Strategy

1️⃣ General Rules

-

The market is overleveraged and crowded with shorts.

-

Two potential scenarios:

-

Short Squeeze (rapid price surge)

-

Liquidation Crash (sharp fall)

-

2️⃣ Action Plan

| Situation | Action |

|---|---|

| Quick Upward Spike (Short Squeeze) | 🚀 Open a small short position targeting a pullback |

| Sharp Downward Move (Crash) | 📉 Avoid chasing the fall; short during the first rebound |

| No Movement (Flat Market) | 🤔 Stay out to avoid getting trapped |

3️⃣ Technical Details

-

Position Size: 30% smaller than usual

-

Leverage: Max 2x–3x

-

Stop-Loss: Tight (1–2% loss)

-

Take-Profit: Risk/Reward of at least 1:2

4️⃣ Risk Management

-

If your position doesn’t move in your favor within 5 minutes, close it.

-

If you lose two trades consecutively, stop trading for the day.

-

Watch funding rates—if they turn positive, short squeeze risks diminish.

📌 Final Thought:

The market right now is like a stretched rubber band.

It can snap up or down at any moment.

Trade cautiously with tight risk management to survive and thrive. 🧠

🚀Join CDDStamp for free and unlock instant access to these powerful insights — no cost, just alpha.

⚠️ Disclaimer:

This analysis is provided for informational purposes only and does not constitute financial advice.

Trading cryptocurrencies involves significant risk and may result in the loss of your capital.

Always conduct your own research and consult with a professional financial advisor before making any investment decisions.