As of 2025, Bitcoin ETFs have triggered a major transformation in the crypto markets.

However, this transformation has not always produced positive outcomes for retail investors.

In particular, the large capital exodus from Grayscale’s GBTC fund towards giants like BlackRock’s ETFs creates a false sense of demand in the market.

We have previously discussed this topic in a brief article. You can read it here. This way you can understand the topic better.

From Grayscale to BlackRock: Capital Migration

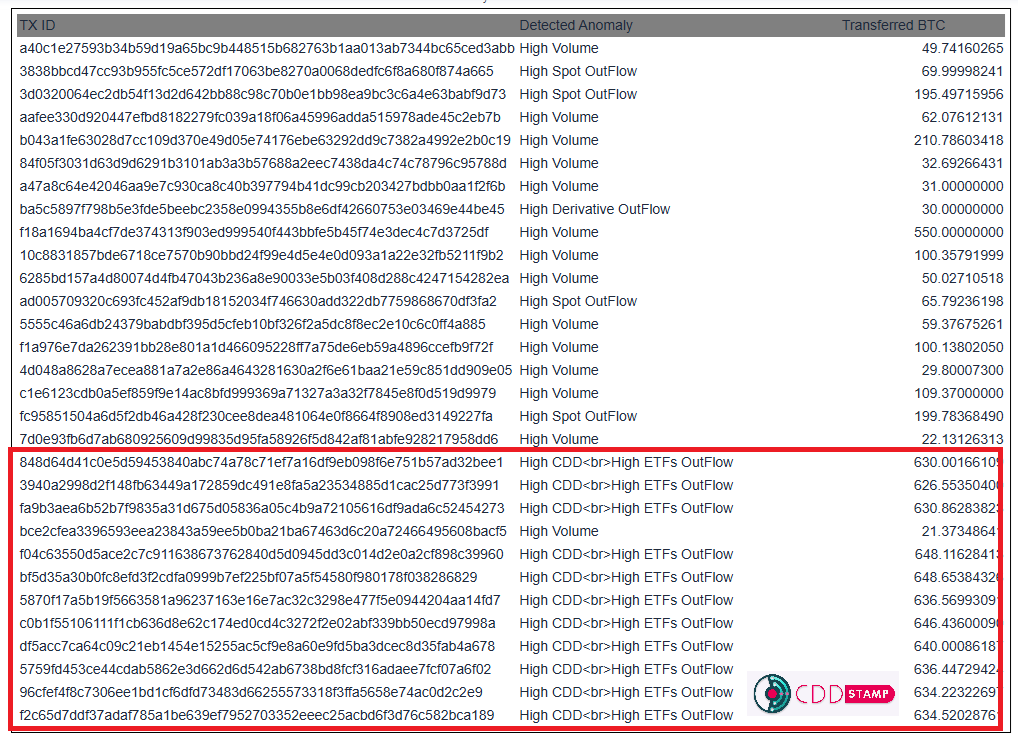

Recently, significant outflows have been observed from Grayscale’s GBTC fund.

For example, on April 28, 2025, GBTC experienced an outflow of $42.7 million.

On the same day, BlackRock’s IBIT ETF saw an inflow of $970.9 million (source: blockchain.news).

This shows that major investors are moving away from Grayscale toward newer ETFs that offer lower fees and greater liquidity.

Apparent Demand Increase: Real or Illusion?

Investors exiting GBTC sell their shares and receive BTC in return.

These BTC are often withdrawn from exchanges like Coinbase.

On-chain data interprets these withdrawals as “BTC purchases,” although they are merely transfers between financial vehicles.

This creates the illusion of growing spot market demand.

ETFs and Market Manipulation

ETFs inject large amounts of capital into the market, pushing Bitcoin prices higher.

However, most of this capital movement happens between large institutional players.

Retail investors, seeing the rising price, mistakenly assume that genuine demand is driving the rally — and they enter the market.

Thus, they unintentionally become part of the bigger players’ strategy.

What This Means for Retail Investors

These developments highlight the need for caution among retail participants.

Without understanding the true drivers behind market moves, investments could end in disappointment.

Especially in the ETF era, major capital movements may send misleading signals that should not be blindly trusted.

Conclusion

Bitcoin ETFs have ushered in a new era for the crypto industry.

But in this new era, retail investors must act with greater awareness and vigilance.

Understanding the real dynamics behind capital flows is critical to making informed investment decisions.

Note: This article is intended to provide an overview of market dynamics and potential risks. Always conduct your own research and consider consulting a financial advisor before making investment decisions.

ETF’ler sayesinde Bitcoin gibi varlıklara kurumsal ilgi artıyor ve bu uzun vadede piyasa için yapısal bir güçlenme sağlıyor. Ancak kısa vadede, ETF’lerin etkisiyle oluşan fiyat artışı gerçek, organik talep artışı gibi görünmüyor.

Bu, bir tür optik illüzyon yaratıyor: Aslında piyasa derinliğinin ve yatırımcı tabanının genişlediği yok, sadece birkaç büyük kurumsal oyuncunun hamleleri var.

Sonra bu sahte güven ortamı içinde perakende yatırımcılar da piyasaya girince, yüksek fiyattan yakalanma riski doğuyor. Büyük oyuncular ise bu durumdan kârla çıkabiliy

Çok iyi tesbitler. Bravo.

Sonuç olarak : Büyük oyuncular ise bu dalgayı kullanıp kârla çıkar.

Sonuç: Küçük yatırımcı risk altında kalır.