In the fast-moving world of crypto, a few seconds can make all the difference. Sudden whale movements, large transfers, and on-chain pressure often lead the price—not follow it. That’s where the mempool monitor becomes an indispensable tool for serious traders.

🧠 What Is the Mempool?

The mempool (short for memory pool) is a temporary holding area where blockchain transactions wait before being confirmed by miners and added to a block. Think of it as a transaction queue.

When someone initiates a BTC transfer, it first appears in the mempool—before it’s confirmed on-chain and long before it impacts exchange balances or price charts.

📡 What Does a Mempool Monitor Do?

Platforms like CDDStamp use advanced mempool monitors to track:

-

Large incoming/outgoing BTC transactions,

-

Transfers from known exchange hot wallets (like Coinbase Prime),

-

Suspicious movements to unknown or cold wallets,

-

Real-time signals of market-moving activity.

These transactions are flagged while they are still unconfirmed, offering a rare window into pre-market moves.

💹 Why Traders Should Care

A mempool monitor gives traders an edge by showing:

-

📥 Incoming BTC to exchanges (potential sell pressure),

-

📤 Outflows from exchanges (accumulation, custody shifts),

-

🧊 Cold wallet moves (HODLing or treasury management),

-

⏳ Transaction patterns before confirmation.

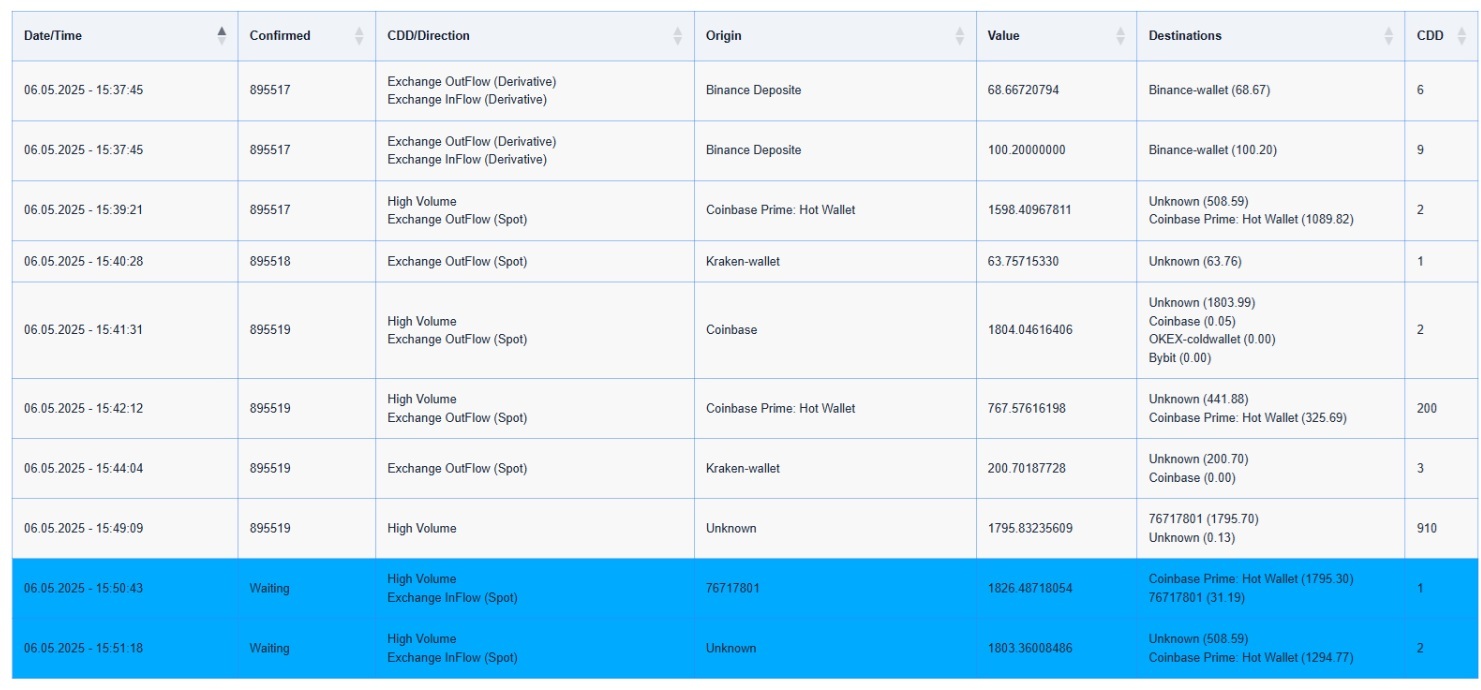

For example, today, the CDDStamp monitor detected a massive 4,505 BTC movement from Coinbase Prime—before it was confirmed on the blockchain:

This type of alert allows traders to act before the market reacts.

🔍 Mempool = Early Intelligence

Waiting for on-chain confirmations or exchange flows often means reacting late.

With mempool data, you see what the smart money is doing before the rest of the market catches up.

Mempool monitoring isn’t just useful—it’s essential.