This analysis combines two core on-chain metrics:

-

Distribution by Balance (wallet balance segmentation)

-

Block-based NUPL (Net Unrealized Profit/Loss – CDDStamp version)

The goal is to clearly determine whether the market is in an uptrend, distribution phase, or a bottoming process.

1. What Does Distribution by Balance Tell Us?

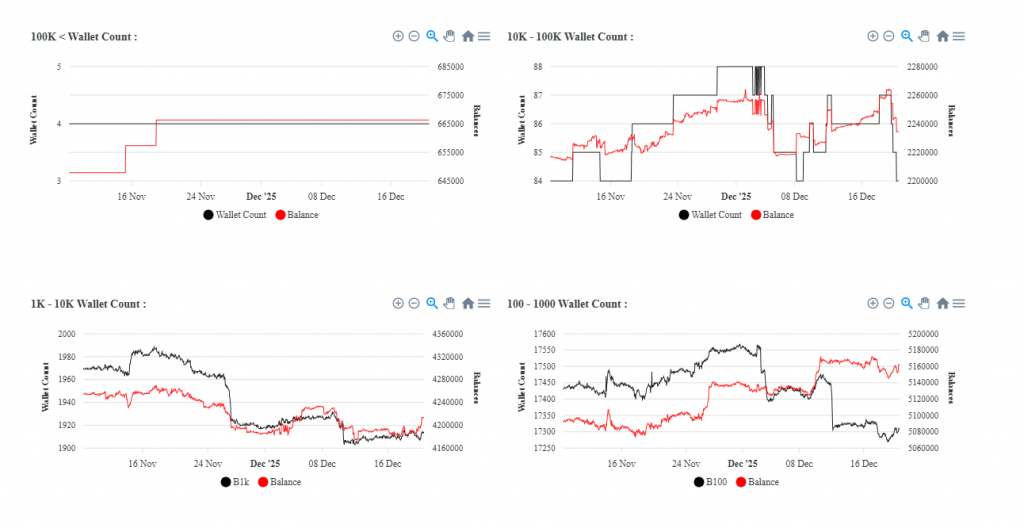

Large Wallets (100K+ BTC, 10K–100K BTC)

-

Wallet counts are increasing, but balance growth is limited.

-

There is no aggressive accumulation.

-

The message is clear: waiting and balance management.

This group is not chasing price.

They are managing exposure, not predicting direction.

Mid-Tier Wallets (1K–10K BTC, 100–1K BTC)

-

Both wallet count and total balance are declining.

-

Historically, this group:

-

Initiates profit-taking

-

Breaks first during volatility

-

Clear conclusion: Controlled distribution.

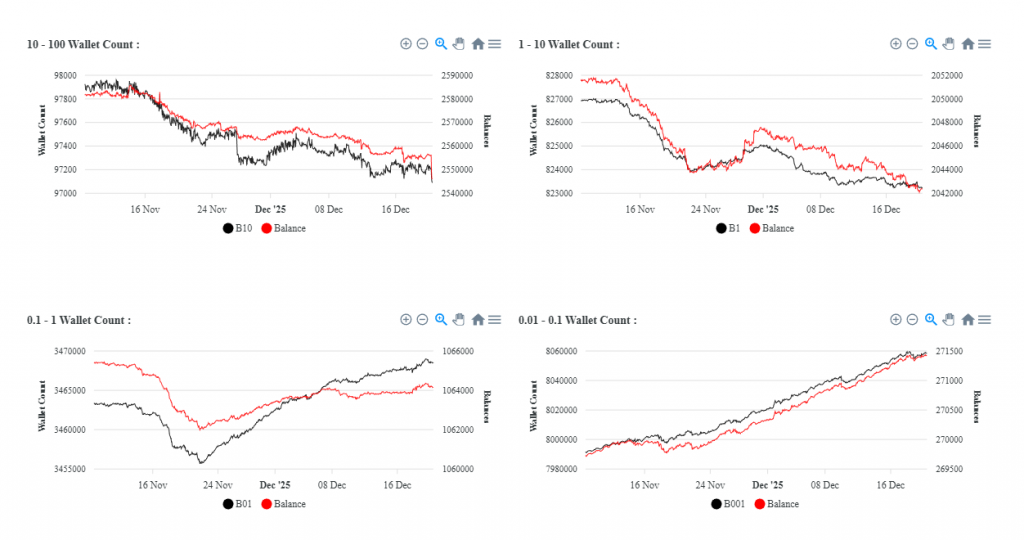

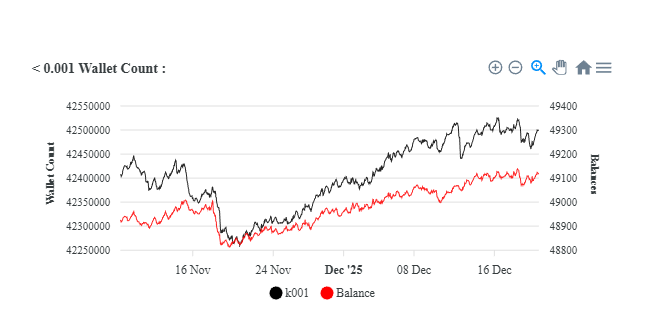

Small and Very Small Wallets (<10 BTC)

-

Net outflows in the 10–100 BTC and 1–10 BTC ranges.

-

Continued inflows below 1 BTC.

This is a classic pattern:

-

Smaller holders exit due to fatigue

-

New participants enter with very small capital

This group does not move price.

It only forms a psychological base.

Overall Distribution Summary

Large holders are waiting, mid-tier holders are selling, small holders are exiting, and the smallest wallets are entering.

This structure does not indicate a trend beginning.

It signals a digestive / consolidation phase.

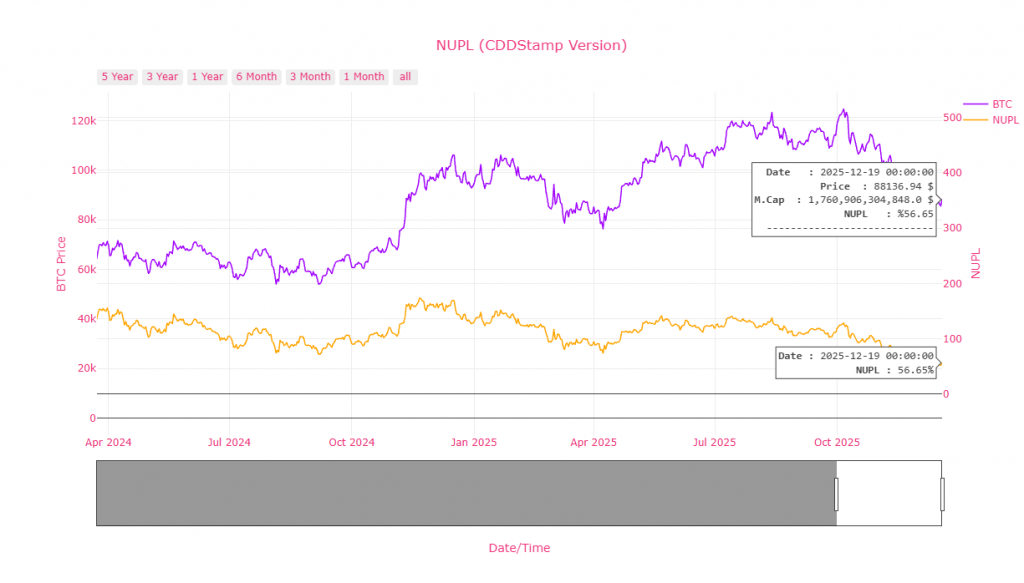

2. What Does Block-Based NUPL Show?

Latest reading:

-

NUPL ≈ 56.6

-

Above the critical 50 threshold

-

But clearly trending downward

This combination matters.

Interpretation:

-

The market is still in profit

-

But profit expansion has stalled

-

New enthusiasm is not forming

Historically:

-

Major tops show much stronger NUPL spikes

-

The current level reflects neither euphoria nor fear

This is not a top signal.

It is a loss of momentum signal.

3. Why Is NUPL Falling While Price Remains High?

This is often misunderstood.

It means:

-

Price is being held at elevated levels

-

Profitable coins are not moving

-

New buyers are entering at higher prices

-

Long-term holders are not rushing to sell

This is not panic.

This is a patience test.

4. Is There Capitulation?

No.

True capitulation would require:

-

NUPL accelerating toward zero

-

A sharp spike in realized losses

-

Full liquidation of the mid-tier segment

None of these conditions are present.

5. The Bigger Picture: What Is the Market Experiencing?

This structure does not describe:

-

A euphoric bull phase

-

Nor a fear-driven bear phase

It describes something else:

The market is not choosing direction — it is buying time.

These phases typically involve:

-

Prolonged sideways movement

-

Morale-draining volatility

-

Price action designed to exhaust impatient participants

Conclusion

Bitcoin is currently:

-

In profit

-

But lacking enthusiasm

-

Showing distribution without panic

-

Accumulation without aggression

This is not a decision point,

but a waiting and digestion phase.

There is no strong upside catalyst yet,

and no true fear on the downside.

Quick Reference for Readers

-

NUPL below 50 → risk increases

-

NUPL accelerating toward 0 → opportunity zone

-

NUPL pushing above 60–70 → elevated risk

CDDStamp gerçekten mükemmel bir platform 💐💐