As gold trades around historic highs, the most common question is this:

“After such a strong rally, doesn’t it need a correction?”

The question is technically valid—but incomplete. Because gold no longer behaves merely as a commodity or an inflation hedge. What price is telling us points beyond classical cycles, toward a regime shift.

Today’s gold price reflects not only interest rates, the dollar, or inflation, but also systemic risk perception and a global crisis of confidence.

What Price Is Saying

If gold manages to hold near record highs, this does not simply mean “there is demand.” It means the market is repositioning gold as:

- a reserve asset,

- insurance against financial system risk,

- collateral against geopolitical uncertainty.

At this point, price is less about being “expensive” and more about assuming a new role.

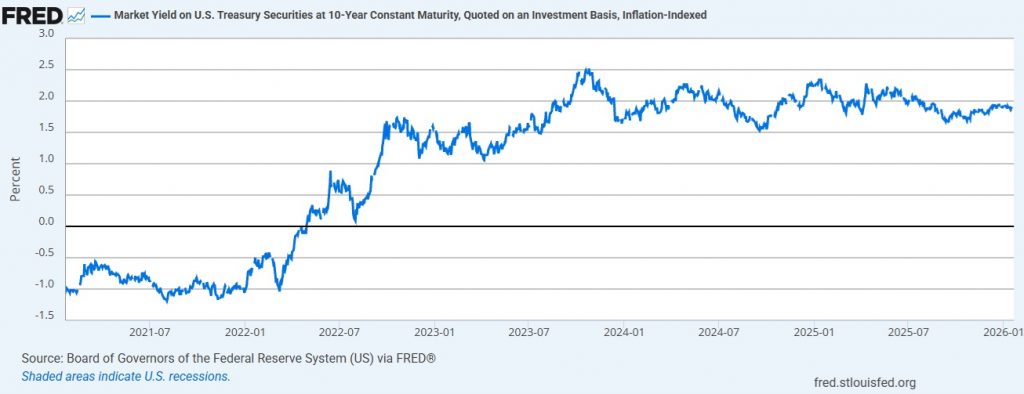

U.S. Real Rates: The Brake Works, But It’s Not Enough

Gold normally struggles when real rates rise, because the opportunity cost of holding a non-yielding asset increases. Yet today, despite historically high real rates, gold is at the top.

This tells us one thing:

The real-rate brake still works, but it is no longer decisive on its own. The market is questioning not “the rate itself,” but the debt sustainability and political credibility behind that rate.

Here, gold is priced not as a return instrument, but as regime collateral.

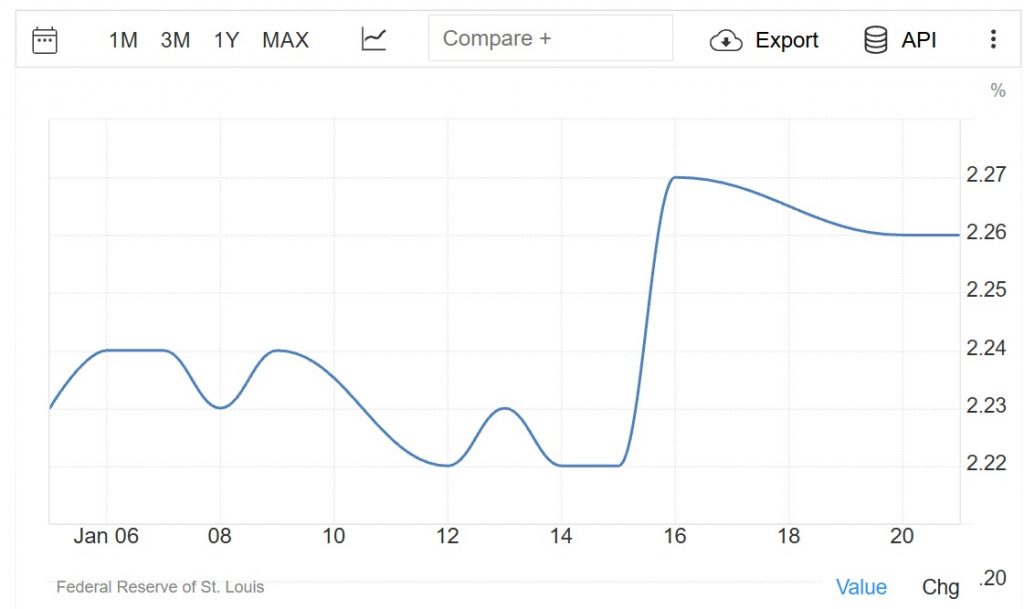

Dollar Index: The Classic Pressure Mechanism Still Applies

As the dollar strengthens, gold is usually pressured. Today’s short-term pullbacks are largely explained by dollar recoveries.

But the striking part is this:

Even with a strong dollar, gold does not collapse. This shows that gold is no longer merely “the opposite of the dollar”; it has become a trust asset in its own right.

Unless DXY enters a sharp and persistent trend, pressure on gold remains limited.

Inflation Expectations: The Invisible Backbone

The market is not pricing hyperinflation. But the perception that inflation will be persistent—and that central banks may not fully control it—is strengthening.

What pushes gold higher is not inflation itself, but this question:

“Is this debt system truly sustainable?”

Gold behaves like the insurance answer to that question.

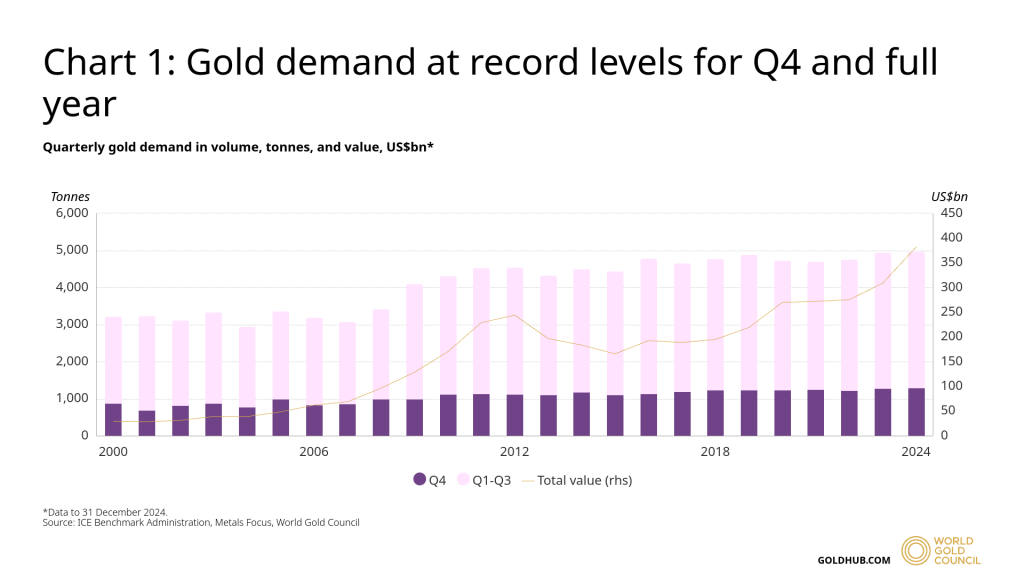

Central Bank Buying: A Structural Base

In recent years, central bank gold purchases have reached record levels. This fundamentally changes price behavior:

- Pullbacks are shorter.

- Lows find buyers faster.

- The market moves with a sense of “permanent demand.”

This demand is not speculative; it is strategic. Therefore, the trend should not be read as a temporary wave, but as a new foundation.

Geopolitical Risk: Instant Premium, Permanent Ground

Gold reacts quickly to headlines. War, crisis, sanctions, tension—

these create short-term spikes.

But today’s rise cannot be fully explained by headlines alone. The real power lies in these events no longer being perceived as “temporary,” but as creating a sense of a lasting new world order.

Gold is no longer merely “the asset bought during war”;

it is collateral against the idea that the order itself can break.

Liquidity and Recession Fear

In the global economy, both scenarios feed gold:

- Easing: money is abundant, money is debased → gold as protection

- Tightening: risk rises, the system weakens → gold as safe haven

This dual structure makes gold unique. While most assets win in one regime and lose in the other, gold can attract demand at both extremes.

Bond Markets and System Trust

Gold’s rise is also linked to growing doubt about bond markets. The era in which government paper was universally seen as “risk-free” is fading.

Debt burdens, political interventions, debates over central bank independence…

These turn gold into “the only collateral that is nobody’s liability.”

So, Won’t a Correction Come?

It will. But in these forms:

- Most likely a time correction: sideways, digesting

- Less likely a sharp wick followed by recovery

- The truly dangerous scenario:

- Persistent dollar strength

- Further rise in real rates

- Clear weakening in central bank and ETF demand

- Long-lasting collapse in geopolitical risk premium

Without these four occurring together, declaring “the trend is over” is premature.

Conclusion

Gold is expensive today not because it is “overbought,”

but because confidence in the world order is eroding.

This pricing is not a rally; it is a regime-shift narrative.

The danger is not that gold is expensive.

The danger is when everyone starts believing it can “never fall.”

The real break begins when strength fades.

For now, gold still represents strength itself.