📊 1. On-Chain Indicators

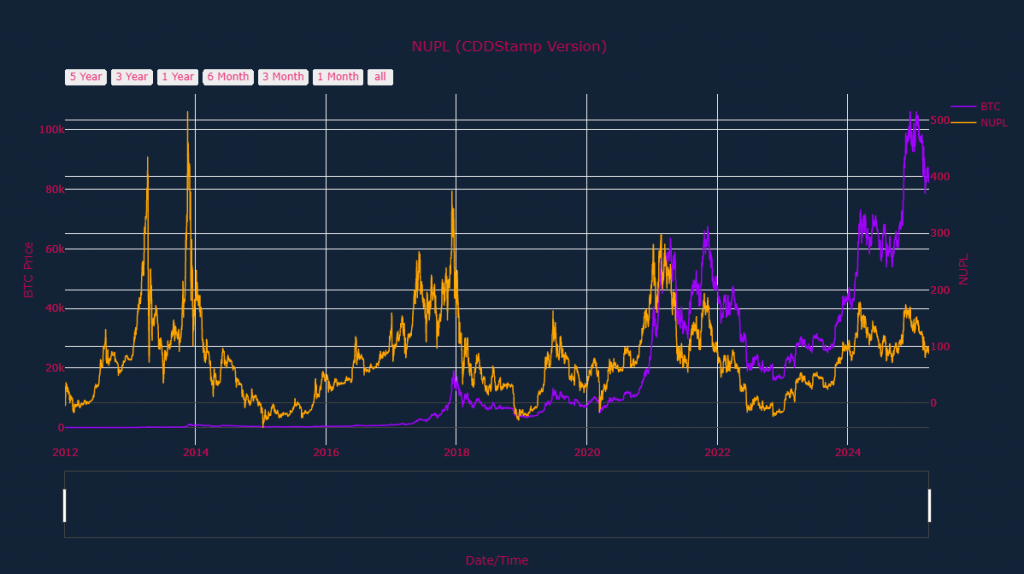

✅ NUPL (Net Unrealized Profit/Loss)

-

NUPL has pulled back from historically high levels. This suggests that most investors are still in profit, but a local top might be in.

-

Historically, similar levels have preceded corrections (e.g., 2017, 2021).

📉 Risk of a correction is elevated.

Sit back and relax, we’ll find patterns in the crypto market for you. Try CDDStamp for free today!

Sit back and relax, we’ll find patterns in the crypto market for you. Try CDDStamp for free today!

✅ MVRV Z-Score

-

It peaked around 4–5 and is now pulling back. These zones usually indicate overvaluation and market tops.

-

Every previous bull cycle saw pullbacks after this level.

⚠️ Strong warning of potential topping.

🔄 2. Derivatives Market

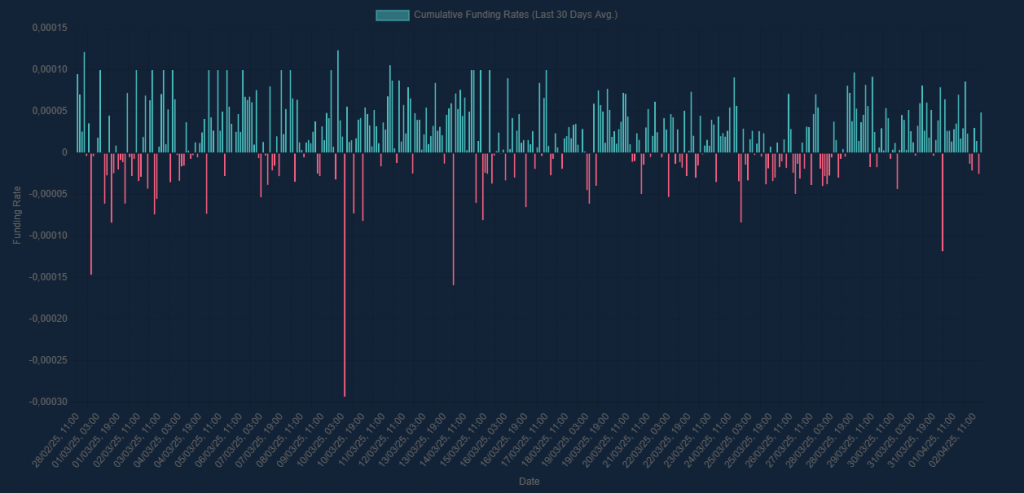

✅ Funding Rates

-

Predominantly positive funding → long positions are dominant.

-

When funding is too positive, it signals market euphoria and can lead to a long squeeze.

⚠️ Overconfidence = possible volatility ahead.

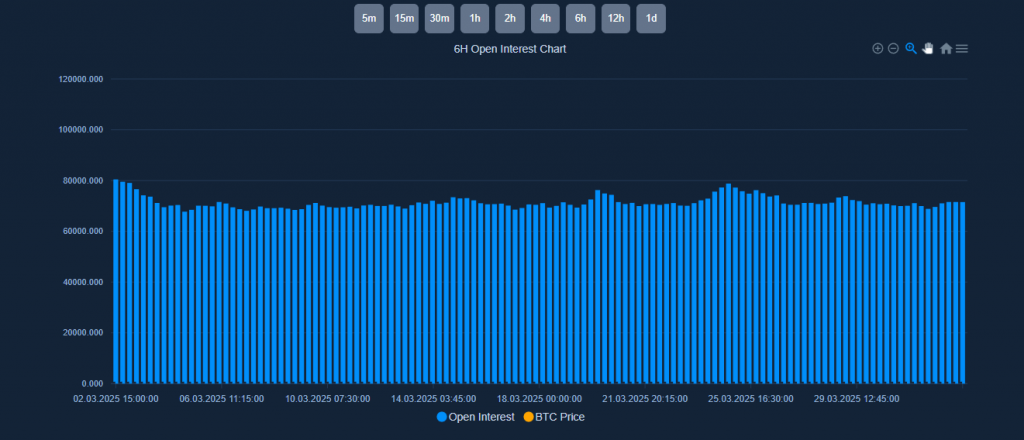

✅ Open Interest

-

High and steady open interest shows significant capital in derivatives.

-

If price drops while OI remains high, liquidations are likely.

💣 Potential for rapid downside moves.

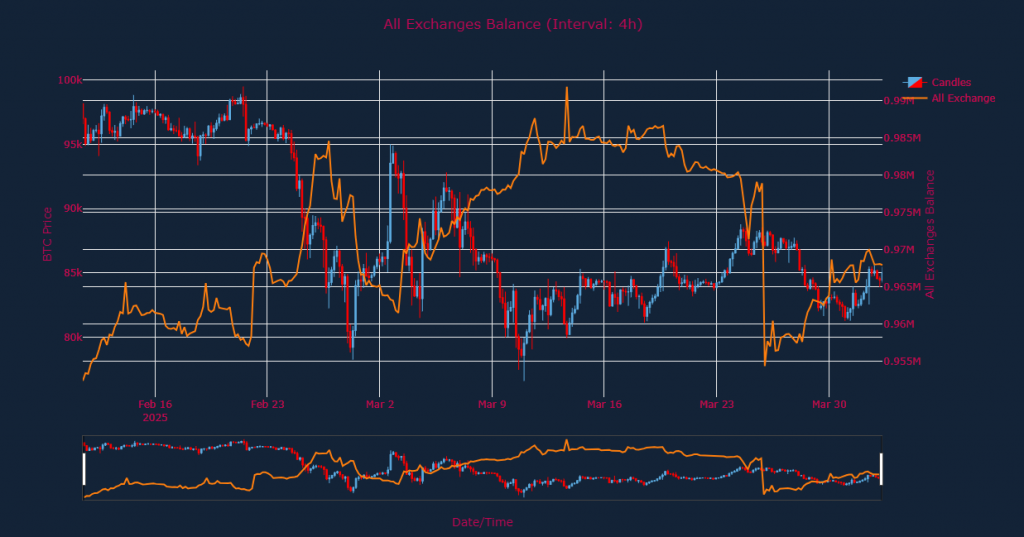

🏦 3. Exchange Balances & Wallet Behavior

✅ Exchange BTC Balances

-

Decreasing balances suggest accumulation (investors withdrawing to cold storage).

🟢 Bullish long-term signal.

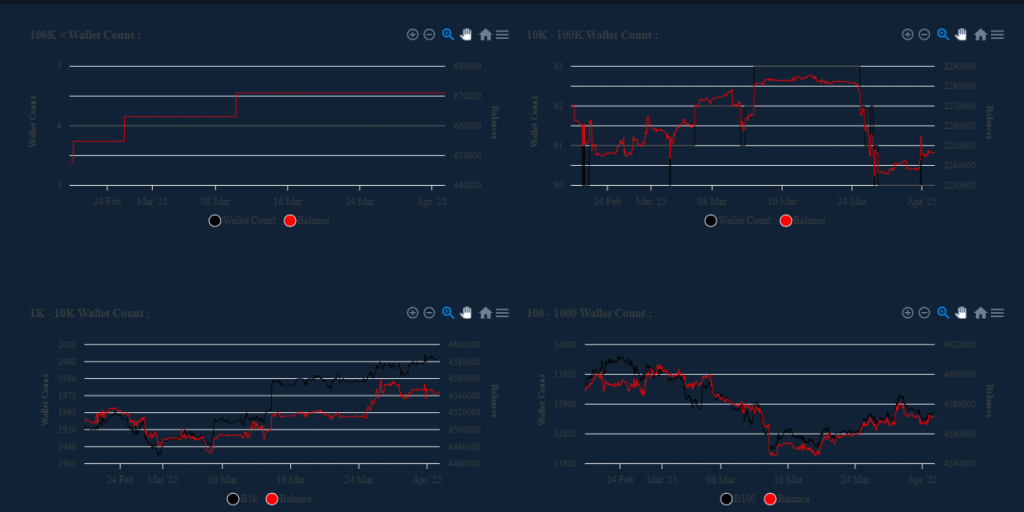

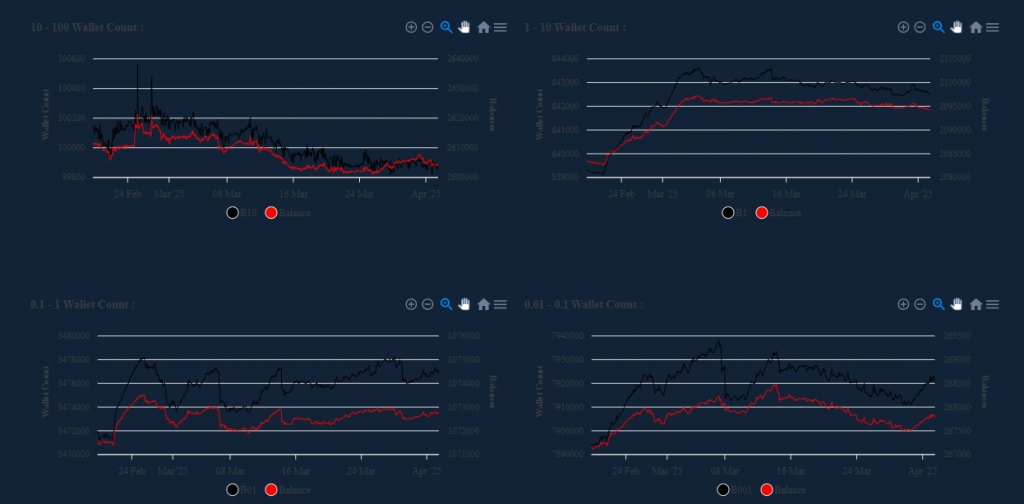

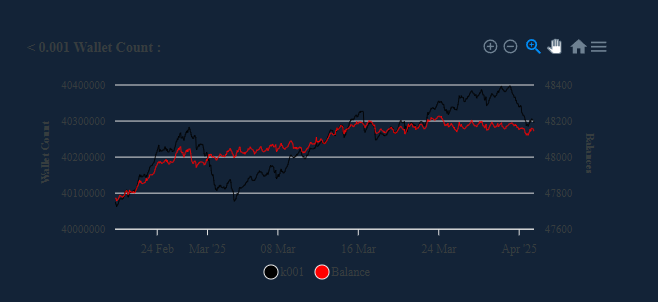

✅ Wallet Distribution

-

Retail wallets increasing → possible late-stage FOMO.

-

Whale wallets declining → possible distribution (selling).

⚖️ Profit-taking phase could be in progress.

🔔 Overall Market Sentiment

| Category | Status | Interpretation |

|---|---|---|

| On-Chain | NUPL & MVRV at cycle tops | Profit-taking phase likely |

| Derivatives | High funding, elevated OI | Risk of liquidation events |

| Wallet Activity | Retail up, whales down | Smart money exiting, caution advised |

| Price Position | Around STH realized price | Critical decision level |

📅 Strategic Outlook

-

Short-Term Traders: Tighten stop-losses, expect increased volatility.

-

Long-Term Investors: Consider partial profit-taking, reaccumulate later.

-

New Buyers: Not an ideal entry zone — wait for clearer structure or correction.