Bitcoin entered 2025 with strong upward momentum but seems to have entered a consolidation phase in recent weeks. So, what do on-chain metrics tell us? Will the uptrend continue, or will the correction persist? Here’s a data-driven, realistic analysis based on the latest indicators.

Sign up for free today and get one month of access to our AI, sezAI, for cryptocurrency and stock market predictions.

Sign up for free today and get one month of access to our AI, sezAI, for cryptocurrency and stock market predictions.

🔵 1. NUPL (Net Unrealized Profit/Loss): Profits Are Fading, FOMO Eases

The NUPL chart shows that most investors are still in profit. However, a key detail stands out: NUPL has been trending downward recently. This suggests a growing tendency to realize profits and a shift toward more cautious behavior.

-

NUPL is falling from elevated levels → The euphoric phase may be ending.

-

Still in the positive zone → Not a bear market signal yet, but caution is warranted.

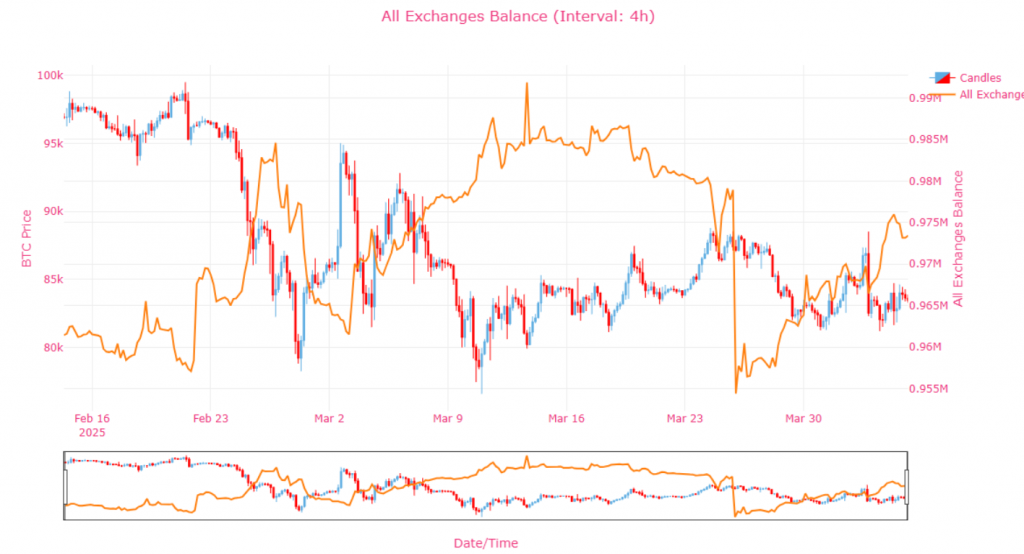

🟠 2. BTC Balance on Exchanges: Still Dropping, But Slowing

Historically, declining BTC balances on exchanges indicate long-term holding and reduced selling pressure. In the latest data:

-

Exchange reserves dropped between February and March 2025, supporting bullish momentum.

-

But by late March, the rate of decline slowed, and minor upticks were observed.

This may signal the beginning of profit-taking behavior. While the long-term trend remains bullish, short-term selling pressure could increase.

📊 3. MVRV Z-Score: Pullback from Overheated Zone

MVRV Z-Score helps us understand how “overvalued” the market is relative to its fair value. The chart shows:

-

Z-Score reached levels around 10, typically associated with cycle peaks.

-

It has since started to pull back, suggesting a cooling-off phase.

This doesn’t yet indicate a bear market, but rather a healthy correction after a strong rally.

⚒️ 4. Puell Multiple: Miners Are Profitable, But Not Dumping

Puell Multiple tracks miner behavior and profitability. Currently:

-

Values above 10 show miners are deep in profit, increasing the potential for selling.

-

But levels are not yet extreme compared to previous peaks.

In short: Some miner selling may be happening, but no panic.

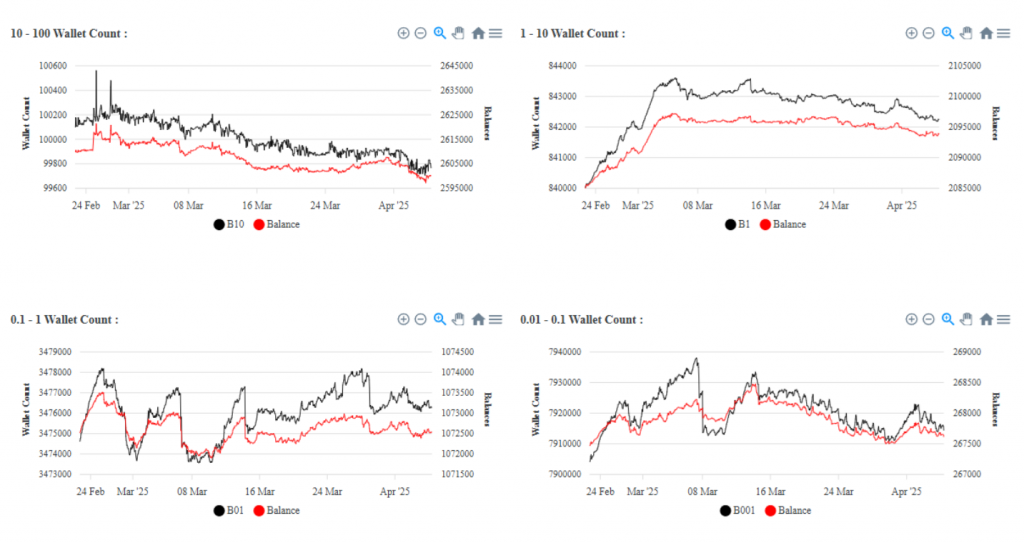

🧩 5. Fragmentation Monitor and UTXO Analysis: Retail Entry Slowing

Fragmentation Monitor revealed that retail investor participation surged during the recent rally. However, as of April 2025:

-

UTXO count has begun to decline slightly after a peak.

-

This indicates that the pace of new retail entry is slowing.

That could mean the momentum behind the rally is weakening.

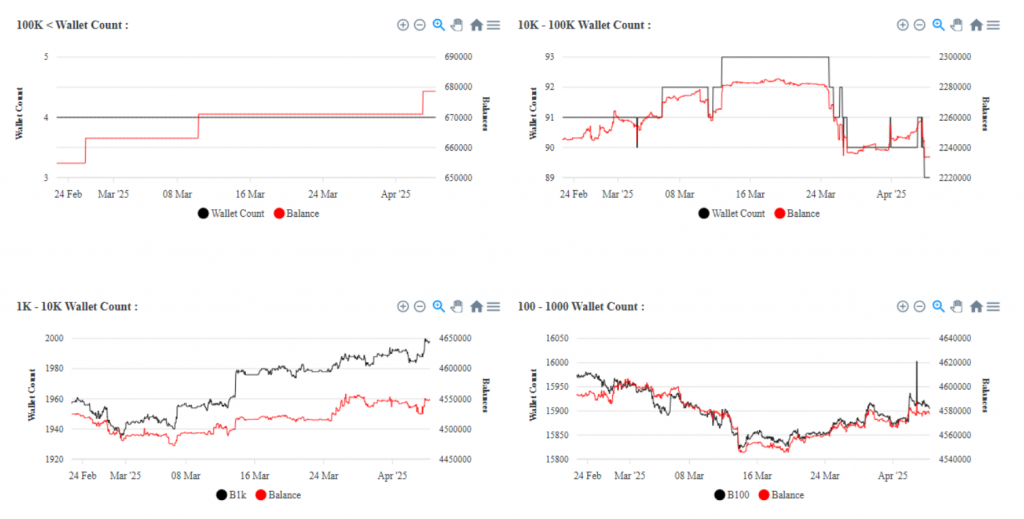

🐋 6. Wallet Segmentation: Whales Accumulating, Retail Hesitating

Looking into wallet activity:

-

100K+ wallets (whales) are increasing – this may point to institutional activity.

-

1–10 BTC wallets remain flat or slightly down, suggesting smaller investors are unsure.

Notably, 10–100 BTC wallets are decreasing, indicating that mid-size holders might be realizing profits.

🎯 Summary Table:

| Metric | Status | Interpretation |

|---|---|---|

| NUPL | Trending downward | Profit-taking behavior is increasing |

| Exchange BTC Reserves | Declining slowly | Selling pressure may be emerging |

| MVRV Z-Score | Pulling back | Market cooling after overheating |

| Puell Multiple | High, but stable | Miners in profit, no panic selling |

| UTXO/Fragmentation | Slight decrease | Slower retail entry |

| Wallet Segments | Whales up, retail flat | Institutions buying, retail on the sidelines |

Sign up for free today and get one month of access to our AI, sezAI, for cryptocurrency and stock market predictions.

Sign up for free today and get one month of access to our AI, sezAI, for cryptocurrency and stock market predictions.

Final Thoughts: Cautious Optimism

On-chain metrics still reflect a strong underlying structure for Bitcoin. However, several indicators now point to a cooling phase where profit-taking and hesitation dominate.

📌 Long-term trend remains positive, but short-term price action may be range-bound or corrective. Whale activity should be closely monitored, and a renewed surge in retail participation could reignite upward momentum.