Technical Breakdown: Bitcoin Forms a Death Cross as Price Sinks Below MA200

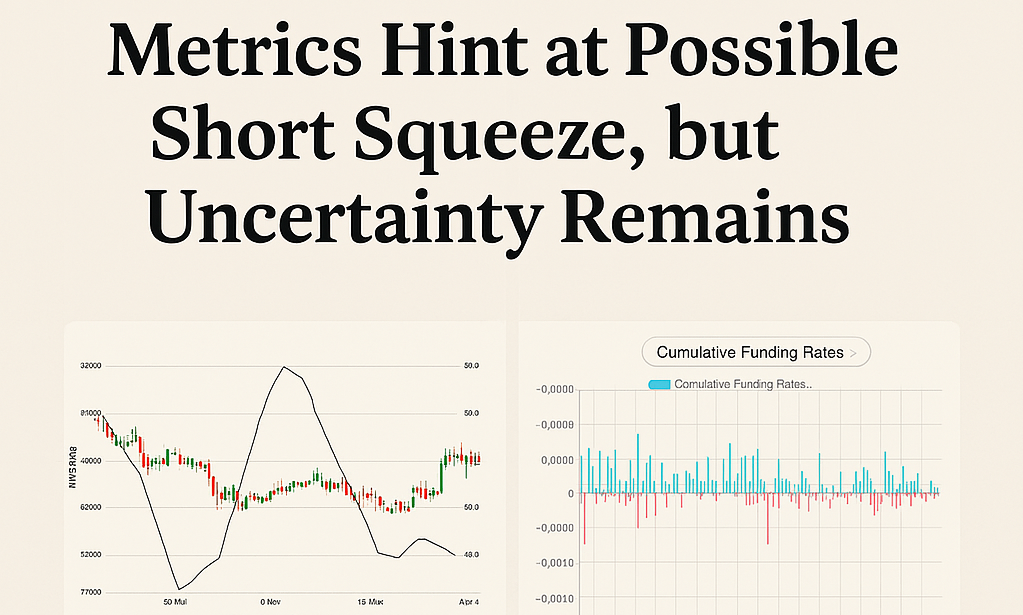

In recent days, Bitcoin has displayed a bearish technical signal that’s drawing serious attention from analysts and traders alike. A Death Cross formation has occurred—when the 50-day Simple Moving Average (SMA50, orange line) crosses below the 200-day Simple Moving Average (SMA200, purple line). This crossover often signals a shift in market momentum from bullish to […]

Technical Breakdown: Bitcoin Forms a Death Cross as Price Sinks Below MA200 Read More »