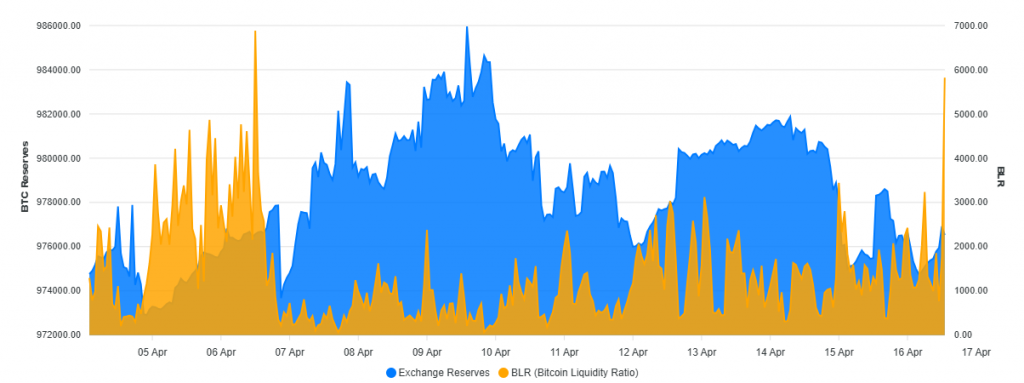

📊 1. Exchange Reserves & BLR (Bitcoin Liquidity Ratio)

-

Exchange Reserves (Blue): From April 5 to 10, BTC reserves on exchanges increased notably, followed by a decline.

-

BLR (Orange): Around April 15–16, the BLR spiked sharply. Since BLR = Exchange Reserves / Trading Volume, this implies either a drop in trading volume or an increase in reserves.

Sign up for free on CDDStamp today and get one-month access to our AI predictor, sezAI, for crypto and stock market forecasts.

Sign up for free on CDDStamp today and get one-month access to our AI predictor, sezAI, for crypto and stock market forecasts.

🔎 Interpretation:

High BLR = low liquidity. Recently, BTC liquidity has decreased. This often precedes volatile moves or sharp price changes. Especially when BLR rises during low volume, it suggests more BTC is available to sell than being traded.

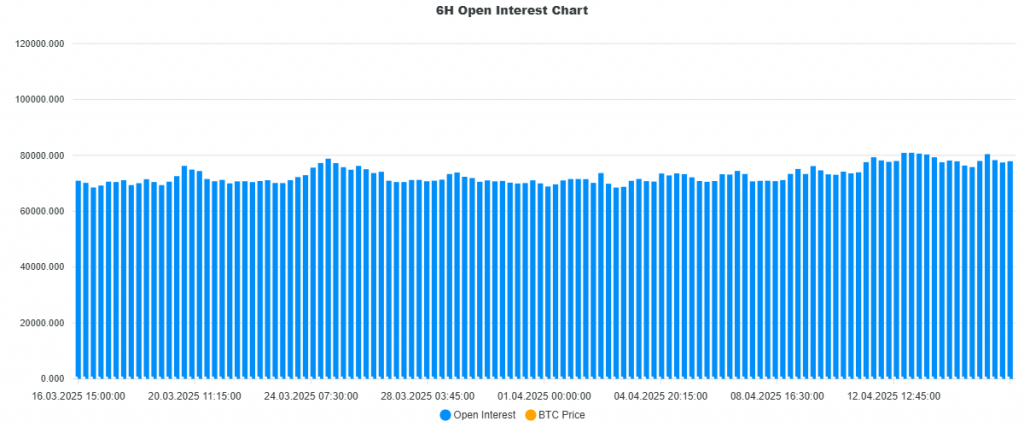

📈 2. Open Interest & BTC Price

-

Open Interest (Blue): Generally trending upward from March 16 to April 16, with a noticeable rise after April 12.

-

BTC Price (Orange): Not perfectly synced but somewhat correlated.

🔎 Interpretation:

Rising OI indicates increased leveraged positions. This adds fuel for bigger price swings. While it’s a sign of growing market activity, it also raises the risk of liquidations if the market turns.

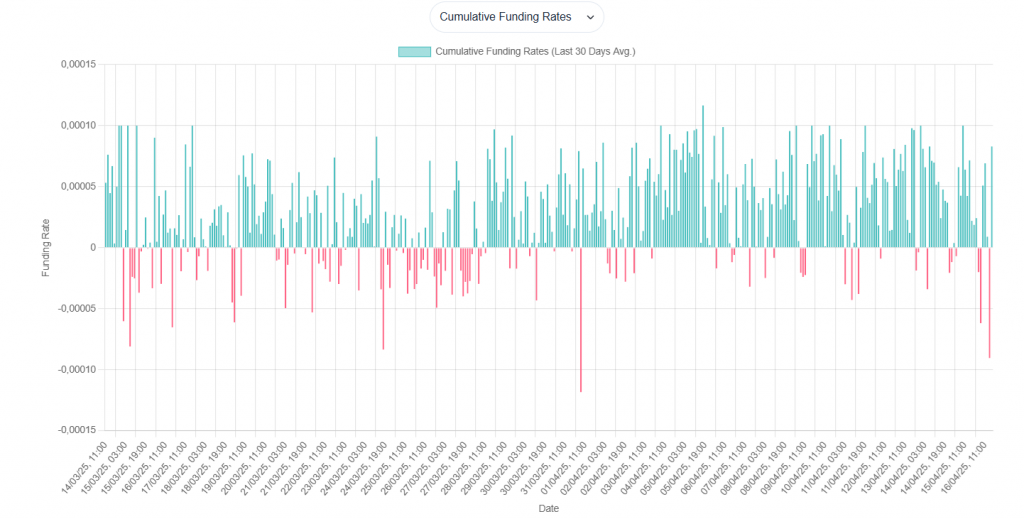

💸 3. Funding Rate (30-Day Average)

-

Positive and negative rates are fairly balanced, but negative funding has increased recently.

🔎 Interpretation:

Short positions are dominating lately. This can lead to a short squeeze scenario if prices reverse upward. Persistent negative funding also shows bearish sentiment is strong.

📉 4. STH Realized Price vs BTC Price

-

BTC price is mostly below the STH RP (Short-Term Holder Realized Price).

🔎 Interpretation:

Short-term holders are holding at a loss. This increases capitulation risk. If the price doesn’t reclaim the STH RP level, selling pressure could intensify.

🏦 5. All Exchange Balance vs BTC Price

-

Exchange BTC balances are increasing while the price is declining.

🔎 Interpretation:

Investors are sending BTC back to exchanges, typically a signal for potential selling. This adds downward pressure to the market.

💡 Overall Summary:

| Indicator | Signal |

|---|---|

| 🔵 BLR | Rising → Lower liquidity, weak trading volume |

| 🔵 Open Interest | Rising → Increased leverage, potential for volatility |

| 🔴 Funding Rate | Negative → Short dominance, possible short squeeze |

| 🔴 STH RP | Price below → Short-term holders underwater, higher capitulation risk |

| 🔴 Exchange Balance | Increasing → Selling preparation or lack of trust |

📍Conclusion & Strategy:

-

A short squeeze is possible in the short term, but selling pressure remains high.

-

Due to elevated BLR and weak volume, any pump may not be sustainable.

-

A true trend reversal needs price to hold above the STH RP (~88–89K).

-

Caution is advised. Keep tight stops and avoid overexposure.

Teşekkürler