Data Range: Last 14 days

Candle Type: 1 Hour (1H)

🔹 1. Price & Volatility Metrics

-

Average Hourly Price (OHLC Mean): $100,452

-

Average Hourly Volatility: 0.55%

This indicates an average 0.55% price fluctuation per hour.

🔹 2. Realized Price Metrics

-

STH (Short-Term Holder) Average: $98,622

-

LTH (Long-Term Holder) Average: $48,119

-

STH-LTH Spread: $50,503

This large spread suggests short-term investors have significantly higher cost bases — a typically bullish structure.

🔹 3. Net Unrealized Profit/Loss (NUPL)

-

Average NUPL: 123.47%

Indicates that most on-chain BTC are in significant unrealized profit, signaling a potential realization risk.

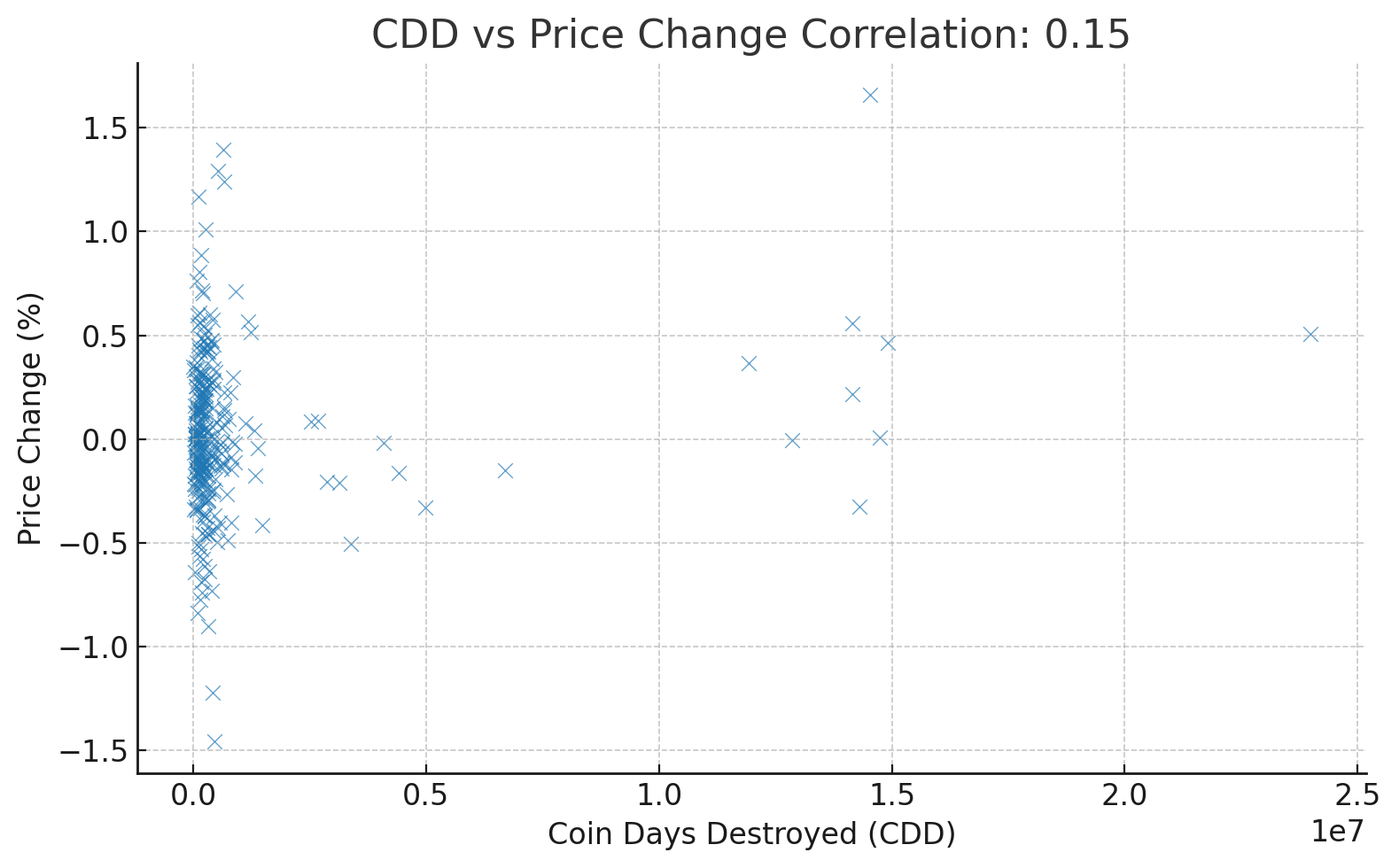

🔹 4. Coin Days Destroyed (CDD)

-

Average Hourly CDD: 833,237

Reflects long-dormant coins being moved — often a precursor to distribution or caution.

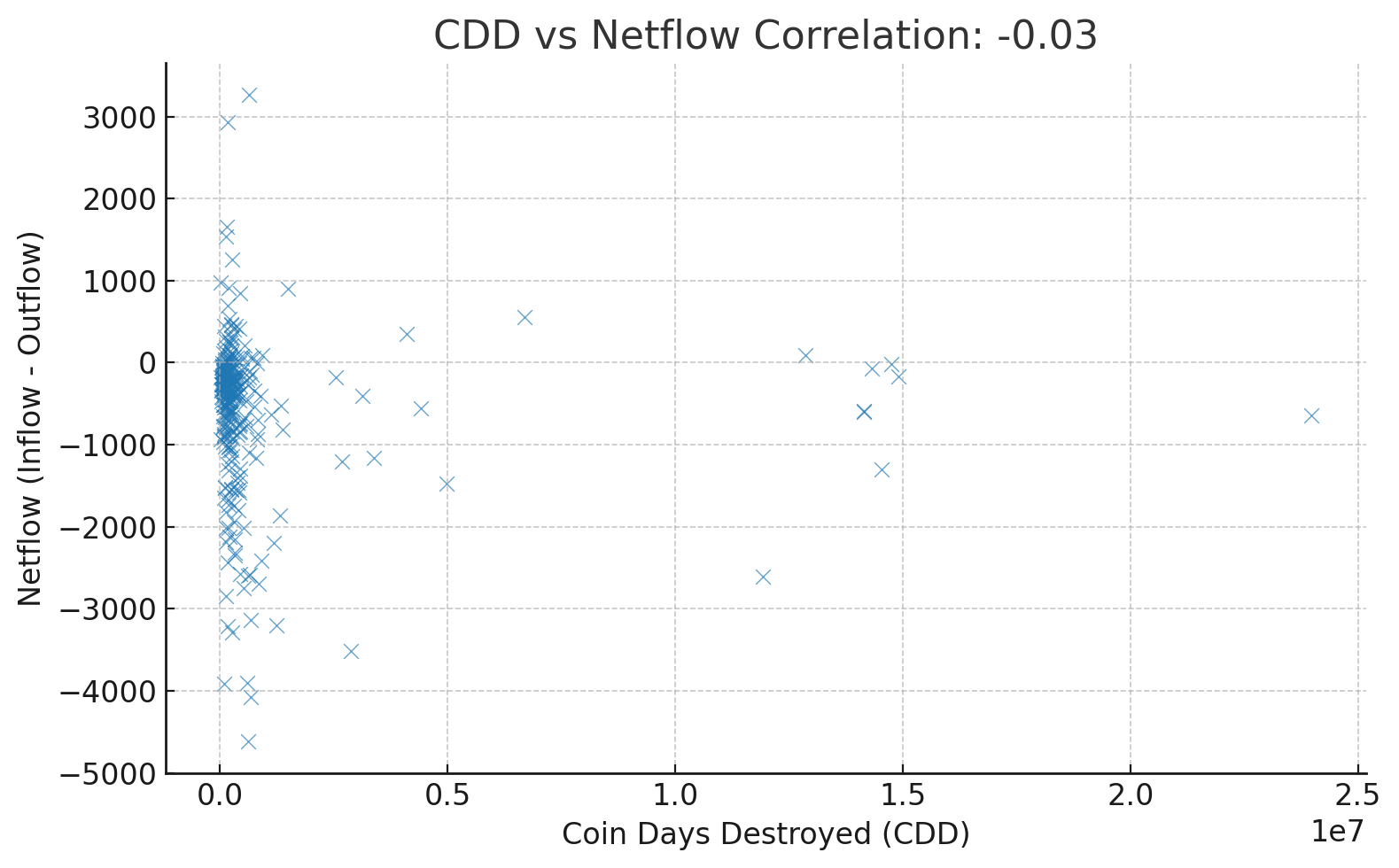

🔹 5. Exchange Flows

-

Average Inflow < Outflow

-

Netflow Average: -578 POL

Negative netflow suggests more coins leaving exchanges — generally bullish (HODLing behavior).

🔹 6. Volume & Activity

-

Avg Hourly BTC Volume: 833 BTC

-

Avg Trades per Hour: 138,815

High trading activity, strong liquidity.

📉 Visual Summary

Hourly Indicator Averages

🔹 7. Technical & On-Chain Cross Signals

| Indicator | Interpretation |

|---|---|

| STH > Price | Short-term holders in loss → reduced sell pressure |

| STH < Price | STH in profit → risk of realization |

| STH MA (7h/30h) | Momentum tracking |

| STH-Price Deviations | Extreme gaps may signal turning points |

| CDD Spike + Inflow | Possible local top or distribution |

| LTH stable, STH volatile | Long-term holders remain calm, short-term active |

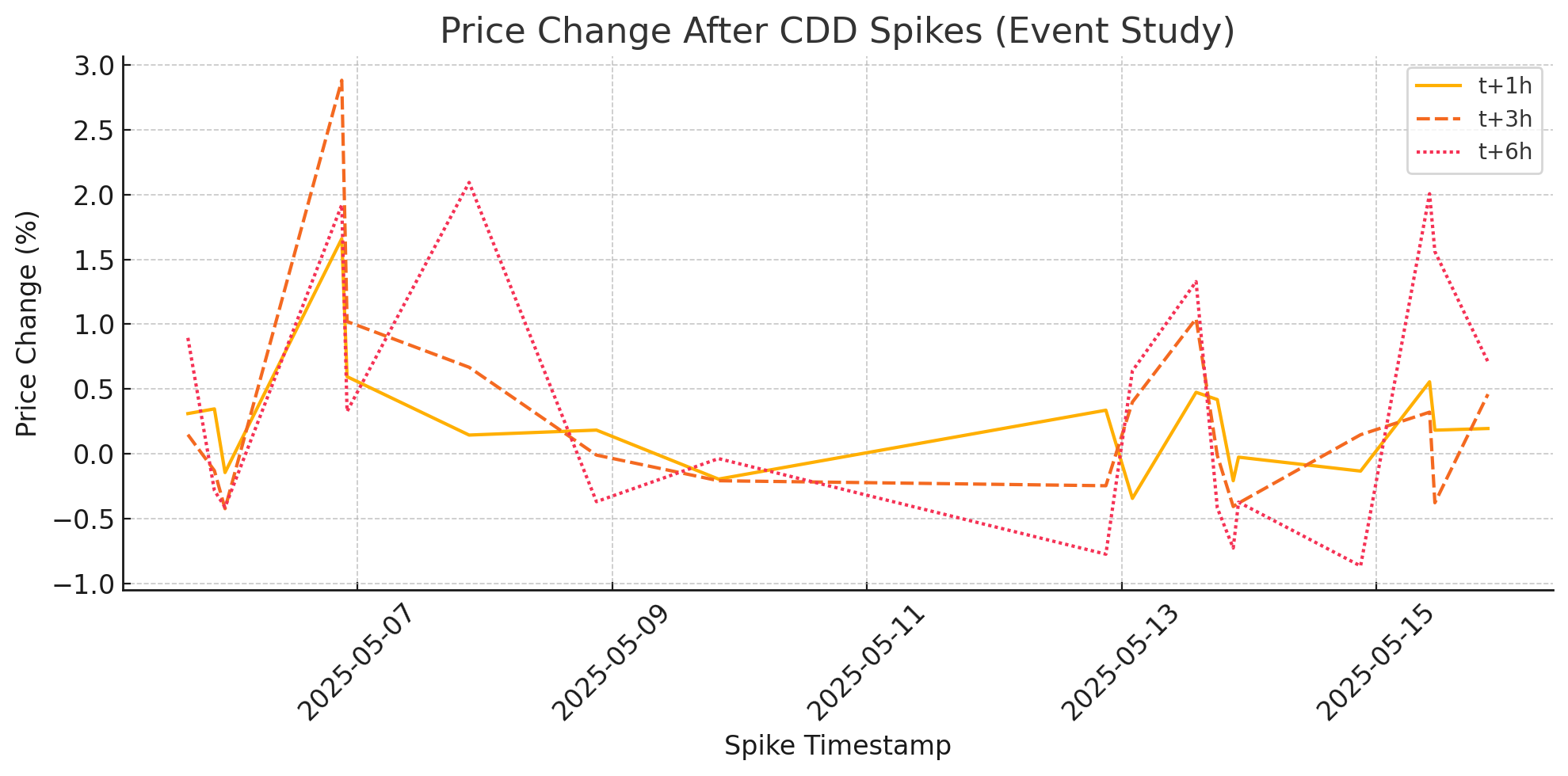

📈 CDD Spike Event Study

Based on the last 14 days of hourly data, the following chart shows how price responds after a CDD spike (a surge in long-held coin movement):

-

🕐 +1h: slight upward movement

-

⏳ +3h: trend continues

-

🕕 +6h: price mostly remains elevated

This suggests that large coin movements are not immediately followed by sell pressure, and may instead reflect strategic repositioning or speculative demand.