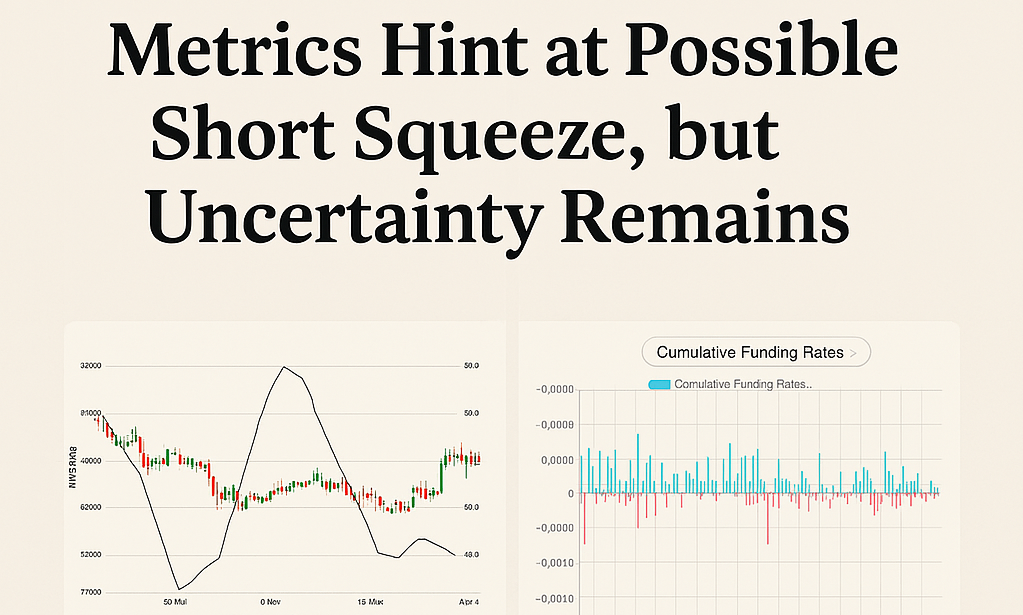

1. BTC Price and Leverage Ratio (Chart 1)

-

Observation: Periods of high leverage (black line) have consistently coincided with price drops, indicating liquidations triggered by over-leveraged positions.

-

Current Status: Leverage has recently decreased while the BTC price has started to climb. This suggests a healthier and more sustainable rally may be forming.

-

Comment: The clearing of excessive leverage is a positive sign and often precedes bullish momentum.

Sit back and relax, we’ll find patterns in the crypto market for you. Try CDDStamp for free today!

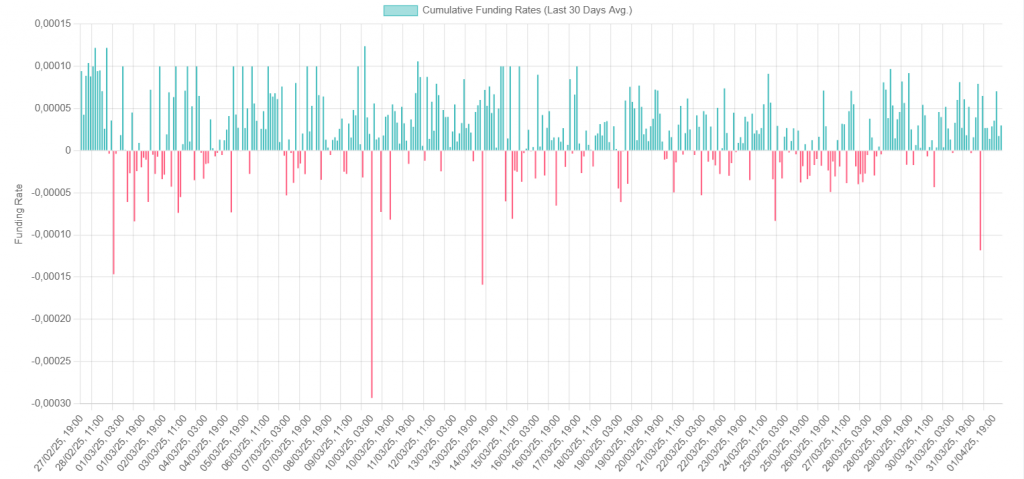

2. Funding Rates (Chart 2)

-

Observation: Funding rates have frequently dipped into negative territory.

-

Comment: This indicates a dominance of short positions. Historically, an overcrowded short market can lead to a short squeeze, pushing prices higher.

-

Extra Note: Heavy shorting usually sets the stage for an upward reversal.

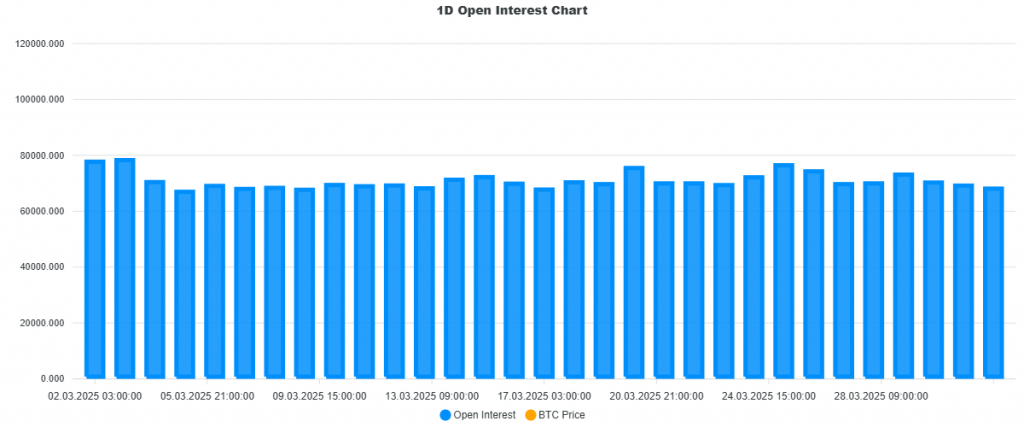

3. Open Interest (Chart 3)

-

Observation: Open interest has slightly decreased in recent sessions.

-

Comment: A reduction in open interest suggests that leveraged positions are being closed, which can lead to more organic price movements. Low OI also means fewer participants, which can reduce sudden volatility—at least temporarily.

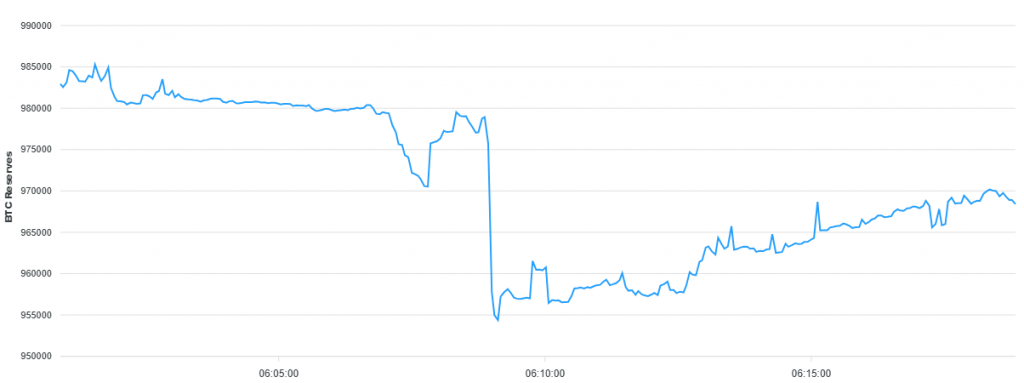

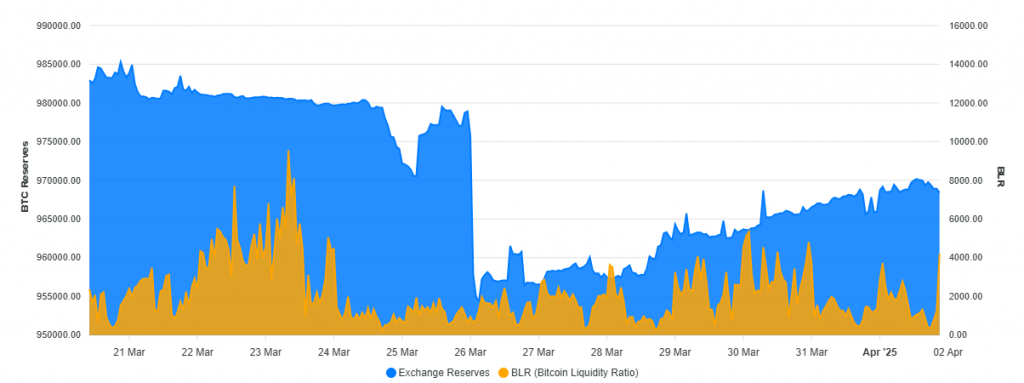

4. BTC Exchange Reserves (Charts 4 & 5)

-

Chart 4: A sharp drop in exchange BTC reserves observed in the short term.

-

Chart 5: Overall BTC reserves have been declining since March 21.

-

Comment: BTC is flowing out of exchanges, likely into cold wallets. This reduces immediate sell pressure and implies accumulation.

-

The BLR (Bitcoin Liquidity Ratio) peaked between March 22–26 but has since dropped, indicating potential for continued price recovery with occasional volatility.

Overall Market Take:

📊 Summary:

-

Leverage has decreased, funding rates remain negative (signaling strong short positioning).

-

BTC is being withdrawn from exchanges, and open interest has cooled.

-

Sell pressure is lightening up, and price action has room to move higher.

🟢 Conclusion: The current setup indicates strong potential for a short squeeze and upward price movement, supported by lower leverage and exchange outflows. However, traders using leverage should stay cautious due to possible volatility spikes.