1. 🧠 On-Chain Analysis

📊 NUPL (Net Unrealized Profit/Loss)

-

Current Status: NUPL remains in the positive zone (above 100%), but has been trending downward since the beginning of the year.

-

Comment: A significant portion of investors are still in profit. However, the decline in NUPL suggests profit-taking and a potential market saturation point approaching.

🚀Join CDDStamp for free and unlock instant access to these powerful insights — no cost, just alpha.

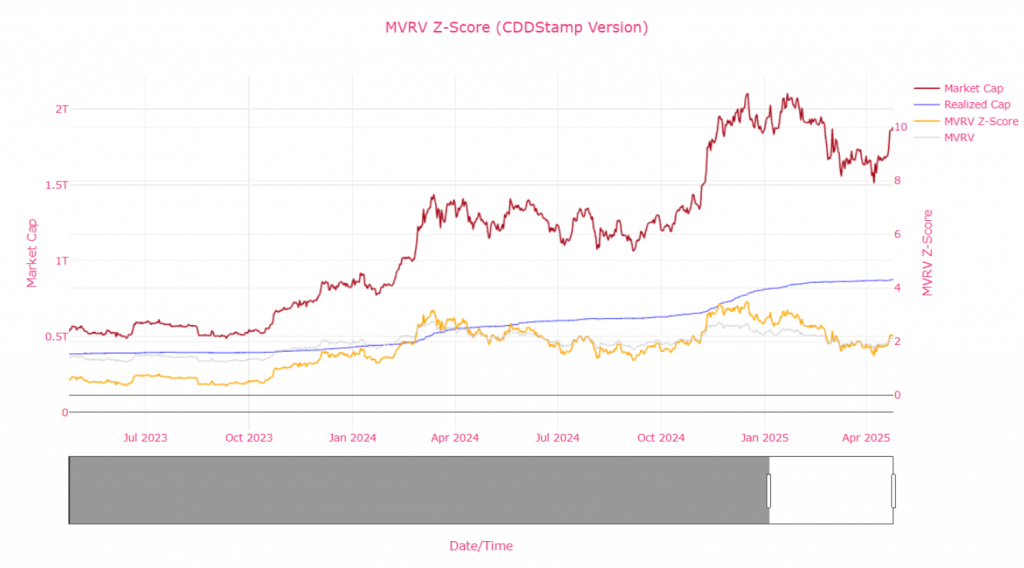

🔍 MVRV-Z Score

-

Observed Level: Recently tested above 10 and is now decreasing.

-

Comment: Historically, this level coincided with market tops. The current descent from overvalued territory may signal a consolidation or a potential correction phase.

💡 Puell Multiple

-

Level: Around 1.5 and moving sideways.

-

Comment: Miner revenue has not yet reached overheated levels, indicating room for further growth and no significant sell pressure yet.

📈 UTXO Fragmentation (Fragmentation Monitor)

-

UTXO Count Rising: Sharp increase observed since March.

-

Comment: Indicates new retail investor participation and broader market engagement. Often a precursor to bullish momentum.

🚨 Block Anomaly Monitor

-

Status: High UTXO outflows and transaction volumes detected. Anomaly frequency is increasing.

-

Comment: May signal movements by large players or institutions. Volatility may increase in the short term.

2. 📉 Technical Analysis

🚀Join CDDStamp for free and unlock instant access to these powerful insights — no cost, just alpha.

📌 Harmonic Pattern: ABCD Structure

-

Pattern: A clear AB=CD formation has completed on the chart, with point D acting as a strong reversal zone.

-

Comment: The bounce from point D confirms a potential trend reversal and the completion of the harmonic structure.

📐 Fibonacci Retracement Levels

-

Resistance Levels:

-

0.618: $94,570

-

0.786: $100,903

-

1.000: $109,588

-

-

Support Levels:

-

0.5: $90,361

-

0.382: $86,339

-

-

Comment: The $94.5K zone is a critical resistance. If broken, price may move toward the $100K–110K area. A drop below $90K could trigger stronger pullbacks.

📊 RSI (Relative Strength Index)

-

Level: 69.02 – nearing overbought zone.

-

Comment: Strong bullish momentum, but approaching overbought conditions. A short-term correction is possible.

📉 Volume Analysis

-

Comment: Rising volume alongside price increases suggests healthy buying activity. Sustained growth will require continued buyer interest.

🔚 Summary Overview

| Indicators | Commentary |

|---|---|

| NUPL | High unrealized profits → Risk of profit-taking |

| MVRV-Z | Signs of reversal from overvalued territory |

| Puell Multiple | Neutral level → Still room for upside |

| UTXO Fragmentation | Increased retail participation → Potential start of new bull cycle |

| Technical Pattern | AB=CD completion → Bullish reversal underway |

| Fibonacci Zones | Watch $94.5K and $100.9K as key resistance levels |

| RSI | Nearing overbought → Potential short-term pullback |

🧭 Strategy Suggestion

-

Short-Term Traders: Consider breakout plays above $94.5K with a target around $100.9K.

-

Mid-to-Long-Term Investors: On-chain signals support long-term holding as retail interest grows.

-

Risk Management: Monitor RSI and MVRV-Z for overheating signs. Key support range lies between $86K and $90K.

Maşallah

Eğer 93.800 kırılırsa düşüş hızlanabilir (çünkü orası tam destek).

Eğer 93.800 üzerinde çok güçlü bir yeşil mum görürsen →

→ kısa vadede bir kısmı karla kapatıp stopu daha aşağı çekmek mantıklı olur.

Güzel fikir, akıllıca teknik.